Navigating the AML and KYC regulatory landscape in offshore locations: key requirements and best practices

Written by John Carr, Chief Risk Officer, MWek Solutions

As financial transactions and ownership structures of the businesses that operate them has become increasingly globalised, the need for robust anti-money laundering (AML) and know your customer (KYC) regulatory compliance has grown exponentially. Offshore jurisdictions play an important role in the global financial system: it is essential for firms to understand the regulatory requirements that each regulator imposes to ensure they combat money laundering, proliferation financing, terrorist financing and other forms of financial crime, and the KYC requirements that must be adhered to that effectively identifies the owners (UBO’s) of the businesses that operate in these jurisdictions.

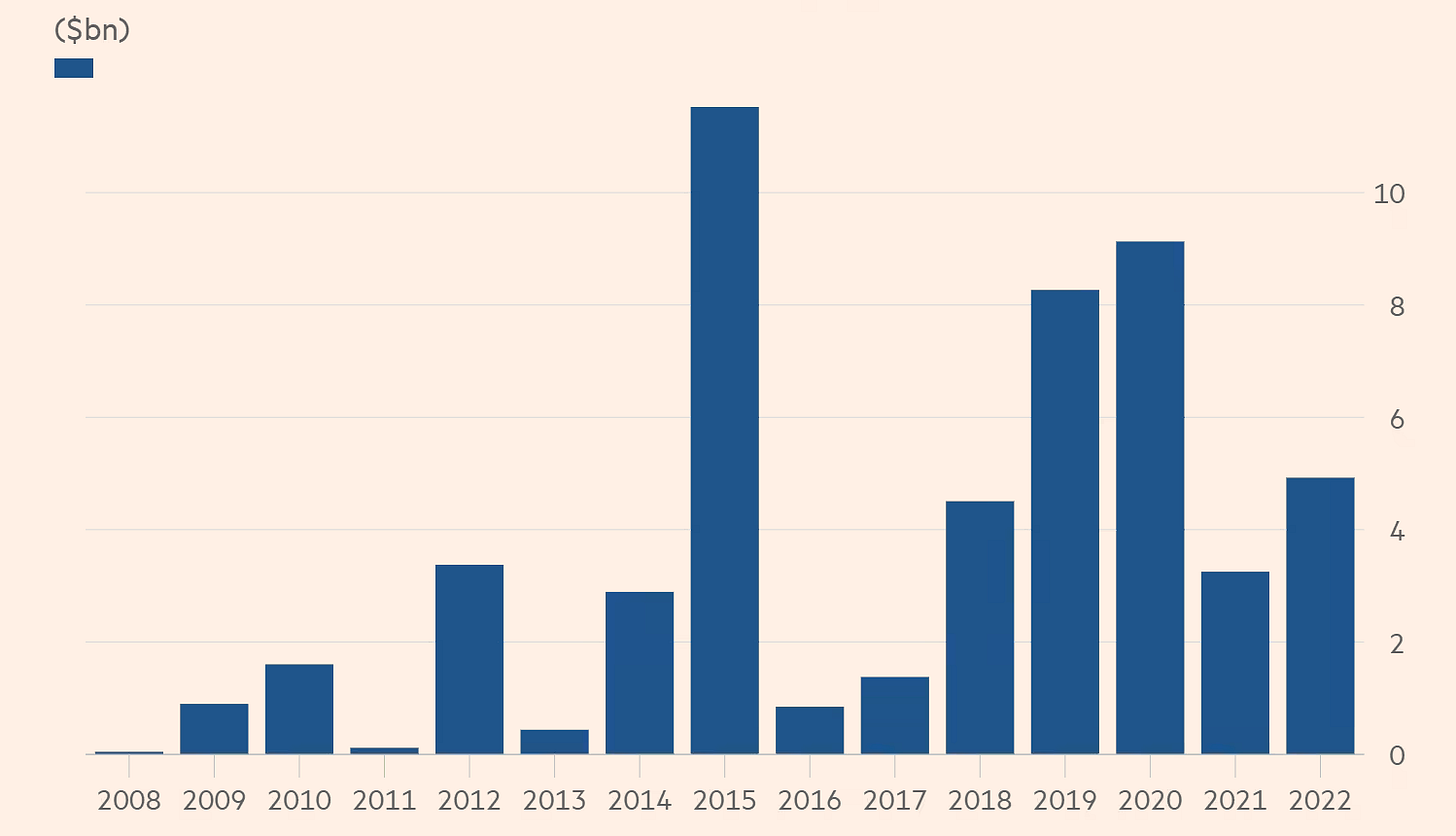

Global fines for AML and related issues surge

In this article, we will explore the key regulatory requirements for AML and KYC in offshore locations:

1. Effective customer due diligence (CDD)

One of the primary regulatory requirements in offshore locations is conducting thorough CDD on the cl…

Keep reading with a 7-day free trial

Subscribe to Digital Bytes to keep reading this post and get 7 days of free access to the full post archives.