Tokenisation does not reduce risk but repackages it

Tokenisation has become one of the most persuasive narratives in modern finance. By converting real-world assets into digital tokens, it promises faster settlement, clearer ownership and fewer intermediaries. Most appealingly, advocates herald tokenisation can lower risk - but will it? Tokenisation does not eliminate risk - it changes where risk lives, how quickly it moves and how visible it is. The economic, operational and counterparty risks present in traditional markets still exist beneath the tokenised layer. In many cases, they are harder to identify; in others, they propagate faster and with broader impact. The danger is not tokenisation itself, but the assumption that digitisation equals safety. As tokenised structures scale across finance, the real challenge is understanding how risk is repackaged, redistributed and occasionally amplified.

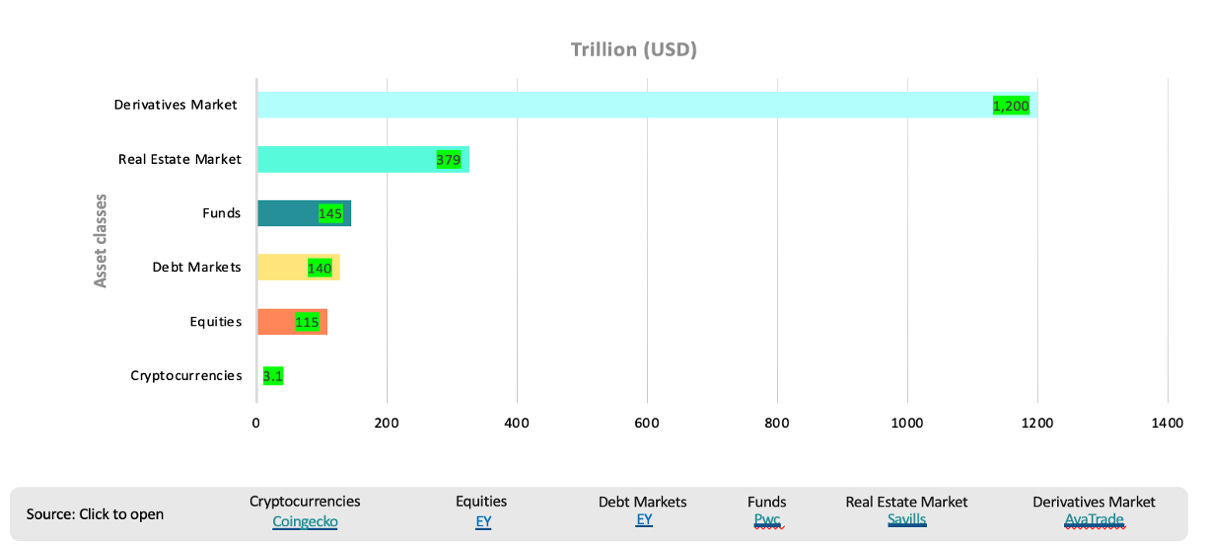

Value of different asset classes that could be tokenised

Source: TeamBlockchain

The potential for tokenisation is huge: the above graph illus…