Tokenised government bonds

Tokenised government bonds are digital representations of traditional government bonds on a blockchain or distributed ledger technology (DLT). Unlike conventional bonds, which are typically issued in physical or dematerialised form and traded through traditional financial institutions, tokenised bonds exist as digital tokens on a blockchain. These tokens represent ownership of the underlying government bond and entitle the holder to the same rights and obligations as a traditional bondholder, including the receipt of periodic interest payments (coupons) and the return of principal at maturity. According to S&P Global:” “The global bond market was valued at $135 trillion, with rated corporate debt making up $23 trillion of the total.”

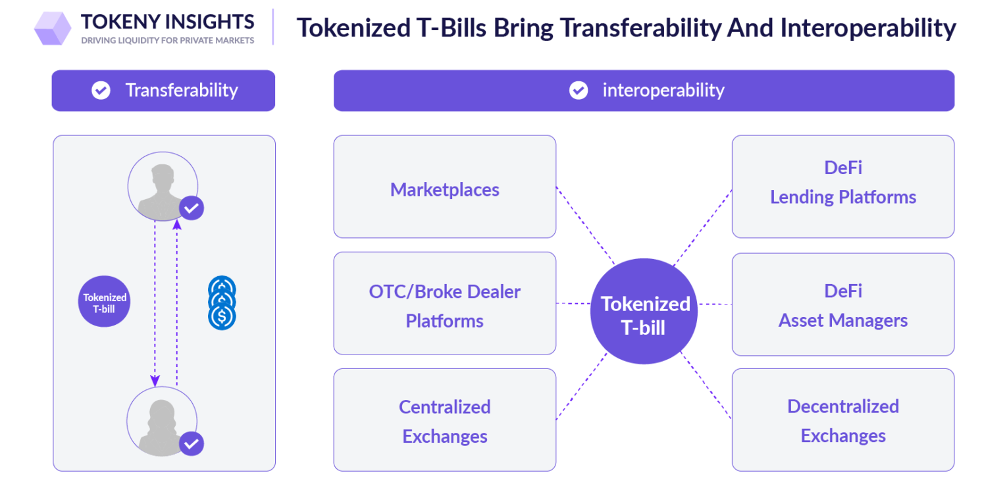

Source: Tokeny

Tokenising a government bond means the government issues the debt instrument in a tokenised form on a blockchain, thus creating a digital token that represents ownership of the government bond. These tokens are distributed to investors digita…

Keep reading with a 7-day free trial

Subscribe to Digital Bytes to keep reading this post and get 7 days of free access to the full post archives.