Embedded finance: the products taking centre stage

Written by Fiona Henderson, Charles Kerrigan and Laura Collins at CMS Law

Roll up, roll up - embedded finance is in town!

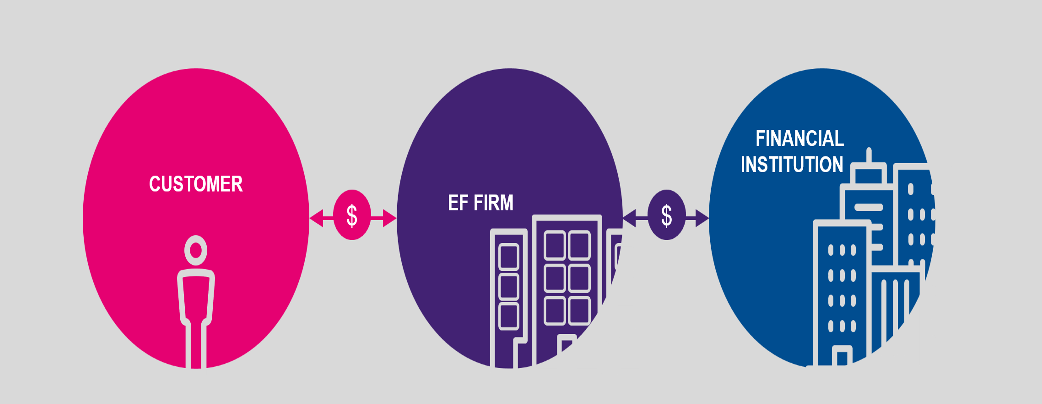

Companies that offer embedded finance products: think, Apple, Klarna, Liberis… the list goes on. The demand for embedded finance products is rapidly growing. As noted by Nik Milanovic (Founder of This Week in Fintech): “in a world where everyone has a supercomputer in their pocket… the most successful financial products will be those that move up the funnel to meet the customer where they are”. It is projected that by 2026, embedded finance products will exceed US$7 trillion of the total US financial transactions (an increase from US$2.6 trillion in 2021). But what is it that these companies offer - what is embedded finance? Put simply, embedded finance (EF) is the availability of financial products, integrated into a company’s infrastructure, provided by non-financial institutions and capitalised by financial institutions.

Source: CMS law

It’s a way of “funding the funding”.

Act 1: the embedded finance leading roles

Broadly speaking, embed…

Keep reading with a 7-day free trial

Subscribe to Digital Bytes to keep reading this post and get 7 days of free access to the full post archives.